Divorce is one of the most financially traumatic things you can go through. Money spent on getting mad or getting even is money wasted. Richard Wagner

The documents should include a statement of each spouse’s financial information, which includes assets and liabilities. It is important that each party provides accurate information on these divorce forms, as any discrepancies or omissions may affect the outcome of the divorce settlement.

In addition to filling out the report, the husband and wife must provide the following documents:

- bank statements

- tax returns;

- mortgage reports.

This will ensure that all assets and debts are appropriately identified.

Once all financial statements have been identified and included in the divorce papers, the court may order mediation or arbitration to resolve disputes over the division of marital property and debts between spouses. In some cases, the parties may reach an agreement without going through this process. However, if a dispute arises, the case will be referred to the court, which will decide the division of property and debts between the husband and wife under California divorce laws.

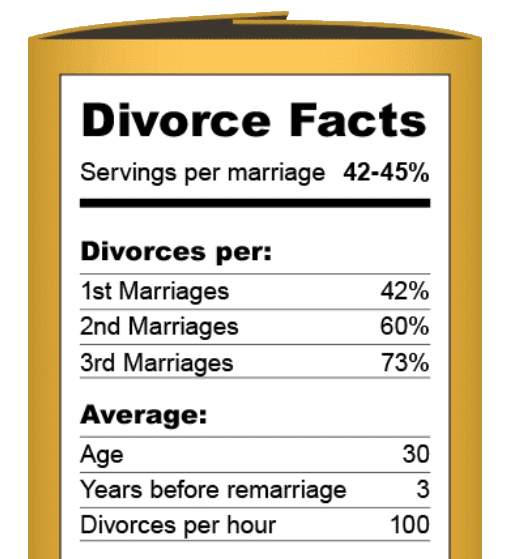

The majority of people are familiar with the fact that “50% of marriages end in divorce”. Researchers think the divorce rate has consistently decreased since the 1980s, when that statistic was initially compiled. According to current divorce statistics, 42-45 percent of marriages in the US result in divorce.

Determine the value of each asset and debt

This may involve that:

- one party retains assets while allowing the other to assume debts;

- selling some of the couple’s joint assets and dividing the proceeds between both parties.

In some cases, spouses may decide to keep the community property and simply agree to split any profits or losses from its sale equally.

Divorce property division can be one of the most complicated aspects of filing for divorce in California. Therefore, couples need to be well aware of their rights under state law before attempting to negotiate a settlement agreement on their own. Consulting with an experienced family law professional can help ensure that all assets and debts are properly valued and distributed following California divorce law.

Consider the tax implications of divorce property division

Different types of property may have different tax consequences. It depends on how they are divided. For example, if one of the spouses owns real estate in the form of a house purchased during the marriage, he or she will have to pay taxes on any capital gains received from its sale later. Similarly, any retirement accounts or assets should be distributed to minimize future tax liabilities.

It is also important to understand the tax implications of any alimony payments between the parties. It is taxable income for the party receiving it and, in most cases, deductible for the party paying. It is necessary to be careful with all documents related to the distribution of property, as there may be questions about the taxes of the former spouse in the future. Having complete copies of Alameda county divorce forms, such as settlement agreements, will help ensure proper tax filing in future years.

Decide how to divide assets and debts fairly

This will help the court decide on a fair division of marital assets. Common assets include:

- real estate

- bank accounts

- investments

- vehicles;

- pension accounts.

In addition, ordinary debts include:

- mortgage loans;

- car loans; and

- student loans;

- credit card debts and other liabilities.

The court usually considers a number of factors when deciding how to equitably divide assets and debts, including

- the income of each spouse

- the length of the marriage

- the age of the husband and wife

- the state of health of each of them;

- their respective contributions to the marriage.

The court will also consider any written agreements regarding the division of property or debt that were entered into during the marriage by both parties or by the attorneys representing them in the prenuptial agreement or after the divorce. Both parties must understand their rights under California divorce law when deciding on an equitable distribution of property and debt.

Enter into a settlement agreement

A Request for Order Form (FL-300) must be filed with the court, which contains information about each spouse’s wishes regarding the agreement and the subsequent division of property. After that, both parties must attend a court hearing, where they can present evidence and arguments in support of their proposed settlement. If no agreement can be reached at this stage, the judge may make a final decision on the division of real estate and other joint property.

Once an agreement has been reached, it must be properly formalized in writing and signed by both parties before it becomes legally binding. This is done based on a court order (Form FL-180) with all relevant information. For example, it indicates whether the parties received assets or debts, as well as any other relevant details related to the division of property during the divorce. Once this document is signed by both parties, it becomes final and enforceable under California law.

Consult a lawyer if necessary

Divorce papers must be filed with the court clerk’s office to begin the process of property division. It is important to understand that any agreement in this situation must be approved by a judge before it becomes legally binding. Thus, contacting a lawyer will help to ensure that the documents are filled out and submitted correctly.

The division of property during a divorce can be complicated and time-consuming. If you are not sure how to proceed or have any questions about California divorce laws, we recommend that you seek legal advice from an experienced attorney. A family law specialist can provide valuable guidance on how to best protect your interests and ensure that your property is distributed fairly under state law.

Finalize your divorce decree in court

This item includes agreements regarding:

- division of property

- spousal support; and

- child support, and any other issues that are discussed during or after filing for divorce.

Both parties may seek advice from a lawyer before signing the final judgment. This is especially true if there are questions about property division and child support for minor children. When both parties agree to all the terms and conditions set out in the decree, they can sign it to make it official in court.

Once the documents are signed and approved by the court, a copy of the final decree will be issued and sent to each party. This document is proof that their marriage has been dissolved in accordance with California divorce law. These documents should be kept in a safe place, as there may be recurring disputes and issues in the future that were previously discussed and outlined in the final judgment.