Various types of loans are earmarked for specific purchases. You buy a home with a mortgage loan, you purchase a car with an auto loan and you pay for college with a student loan. When it comes to a personal loan, however, it can be used for anything.

Whether you want to consolidate debt or finance a wedding, a personal loan can help you borrow the money to achieve your goals. With a personal loan, you get a set amount of money and repay it in monthly payments, called installments, for a predetermined period. Depending on your loan, your loan term could range from one year to seven years, though that will vary by lender.

What Is A Personal Loan?

A personal loan is a loan that you qualify for based on your credit history and income. Personal loans are sometimes called unsecured loans because there is generally no collateral to secure a personal loan. Instead, lenders approve personal loans by evaluating your creditworthiness.

Personal loans are relatively easy to apply for and qualify for as compared to home and auto loans. That makes them useful for everything from small home improvements to expensive purchases. You can use the money for almost anything, but it’s wise to borrow only as much as you need and for things that improve your finances or make a significant impact on your life.

How Do Personal Loans Work?

When you get a personal loan, you typically receive your money in a lump sum, and you repay with fixed monthly payments over time. However, the details vary from lender to lender.

Personal loans are unsecured credit with flexible end-use that typically has a tenure of 12 months to 60 months. If a shorter tenure is chosen, individual EMI amounts are higher, while a longer tenure would result in lower individual EMIs.

What are the Features and Benefits of a Personal Loan?

Here are some of the features and benefits of a personal loan:

1. No Collateral/Security Required

Personal loans don’t need you to provide any collateral such as a house or car to avail a personal loan. The loan is approved only based on your creditworthiness, which depends on your credit score, income, repayment history, employer reputation, etc.

2. Flexible End Use

Personal loans can be used for multiple purposes, such as to meet expenses of a medical emergency, travel, house renovation, debt consolidation, etc.

3. Flexible Tenure

Personal Loans usually come with flexible tenure ranging from 12 months to 60 months.

4. Minimal Documentation

Personal loans can be applied for online and even offline with minimal documentation. Key documents that lenders generally need the applicant to provide include a proof of identity, a proof of address and proof of income.

5. Quick Disbursal

Personal loan disbursal can sometimes happen within a few hours, once the application is approved. Turnaround times can also be as short as a few minutes if you can avail of a pre-approved loan offer.

6. Flexible Loan Amount

The personal loan amount that gets disbursed is based on an individual’s repayment history, monthly income, age, profession, employer reputation, and other such factors. Lenders offer personal loans of the amount as low as Rs. 10,000 to as high as Rs. 40 lakhs.

When to opt for a Personal Loan?

Here are some of the top circumstances when it is best to go for a personal loan:

1. Finance a Purchase

Financing a purchase depends on whether it is a want or a need. If you’re going to take out a loan anyway, getting a personal loan and paying the seller in cash might be a better deal than financing through the seller. Don’t ever decide on financing on the spot, though. Ask the seller for an offer and compare it to what you could get through a personal loan. Then you can decide which is the right choice.

2. Wedding or a Large Event

Any large event such as a wedding qualifies if you would end up putting all associated charges on your credit card without being able to pay them off within a month. A personal loan for a large expense like this might save you a considerable amount on interest charges, provided it has a lower rate than your credit card.

3. Consolidating Debt

If you owe money on credit cards with higher interest rates, you can pay off those debts with a personal loan that has a lower rate. You can eliminate debt more quickly because less of each monthly payment goes toward interest costs.

4. Emergencies

Sometimes there are situations when there are no options besides borrowing. For example, when you face medical expenses or you need safe transportation to keep earning income, a personal loan may make sense.

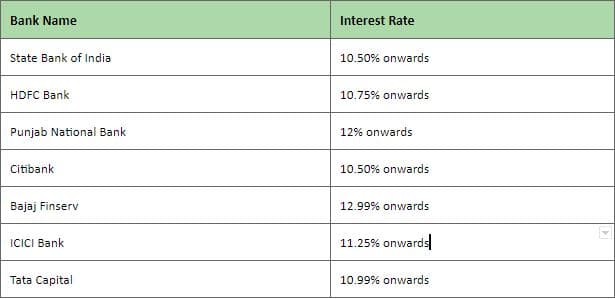

What are the Interest Rates Offered on Personal Loan?

What are the Documents Required for a Personal Loan?

Most banks and NBFCs have similar guidelines with regard to the documents required for personal loans. Here is a generic list of such documents.

- Identity Proof – PAN Card/ Voter’s ID/ Aadhaar Card/ Passport/ Driving License

- Address Proof – Bank Account Statement/ Aadhaar Card/ Lease/ Property purchase Agreement/ Utility Bill (not more than 3 months old)/ Passport/ Driving License

- Income Proof – For Salaried Individuals: Salary Slip/ Bank Account Statement/ Form 16. For Self Employed: Previous Year ITR/ P&L Statement and Balance Sheet/ Bank Account Statement

- Business Proof – Certificate of Practice/ Partnership Deed/ GST Registration and Filing Documents/ MOA & AOA/ Shop Act License

What are the Various Factors to be Considered While Seeking a Personal Loan?

Here are some of the factors to consider before taking a Personal Loan

1. Personal Loan Interest Rate

When you take a Personal Loan, the interest outgo is one of the vital deciding factors. The interest rate you pay depends on a variety of factors: your age, income stability, whether salaried or self-employed, number of years of work experience (in the current job/business/profession) and total), your credit score, existing EMIs (if any), and your repayment capacity, loan tenure, among other things. The interest outgo determines your EMI and has a bearing on your budget and long-term financial wellbeing. So, make sure you apply for the best personal loan rates.

2. Loan Tenure

The maximum tenure for a Personal Loan is usually 5 years. But the shorter the tenure of a Personal Loan, the better it is. A higher tenure can reduce your EMIs, making repayments comfortable, while opting for a lower tenure (of say 2 to 3 years) increases your EMI; you pay a higher interest cost on the Personal Loan.

3. Processing Fee and Other Charges

Taking a Personal Loan does not end with interest rates; there are processing fees and other charges levied by lenders. The processing fee is a one-time fee charged as a certain percent of the Personal Loan amount, but subject to a minimum amount. It varies from lender to lender. A higher processing fee impacts your total cash outflow while you apply for a Personal Loan.

4. Repayment Flexibility

Apart from the above crucial aspects, assess if the lender provides you with the flexibility to repay your loan sooner, and what will this cost you. This flexibility can help you prepay the loan ahead of time, as well as provide relief in distressing times. However, it’s best to adopt financial discipline to repay the Personal Loan on time and maintain your financial health in the pink always.

5. Customer Service

When you avail of a Personal Loan in times of need, you wouldn’t want it to be an unpleasant experience, do you? Hence, ensure the customer service at the lender has high standards. This service can even help keep track of your loan, allowing you to be in better control of your finances.

6. Terms & Conditions

Make sure you read the terms & conditions carefully to make an informed choice. This will avoid issues later and ensure a pleasant, hassle-free experience.

Personal loans can be useful, given the right circumstances. For example, a lot of people can’t afford to pay cash for a big purchase, getting a loan then becomes a necessity. It’s also important to understand exactly what you are agreeing to when you take a personal loan. And you need to have a solid plan for repaying the loan according to your agreement with the lender. Be sure to consult with a trustworthy financial institution and weigh your options.