During divorce proceedings in many states, the court decides who will pay child support based on factors such as:

- income;

- age;

- duration of the marriage.

The court may also take into account who initiated the divorce and the ability of each spouse to pay alimony.

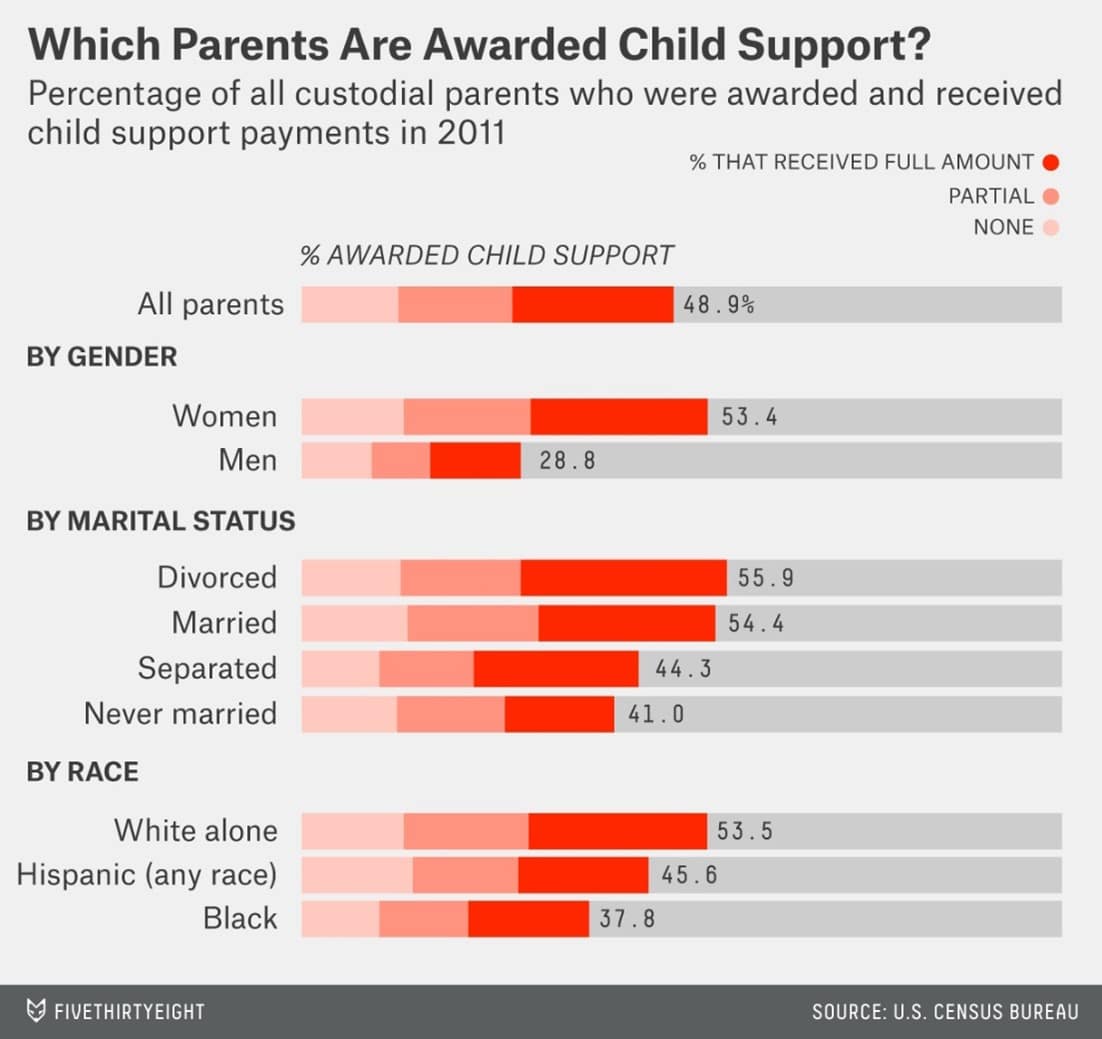

To quickly introduce you to the concept of alimony, we have prepared the following infographic:

Can a man get alimony?

A man can get alimony from his ex-wife if he meets certain criteria set by his state law. Generally, if a man is unable to support himself financially due to illness or injury and cannot find paid employment, he may be eligible for a maintenance allowance from his ex-wife. In addition, if a husband was financially dependent on his wife during the marriage, he is also entitled to financial support.

Do women pay alimony?

If a man took parental leave during his marriage or had difficulty finding a job, he is eligible for financial assistance from his ex-wife. The alimony will help cover living expenses while he looks for work.

The payment of alimony after a cheap divorce in Texas online depends on the specific circumstances of each couple and the decision of the court. Not always payments concern women. The court can oblige a man to do this, his financial situation will be much better than that of his ex-wife.

Here are a variety of statistics on alimony payments provided by FiveThirtyEight:

Factors that determine the amount of alimony

A court order to pay alimony allows you to support the spouses financially during and after the divorce. Before making a final decision on who pays and how much, the court reviews prenuptial agreements and other documents that relate to the case.

In certain circumstances, the responsibility of women paying alimony to their ex-husbands may arise. This is possible if it is established that he is financially dependent on his spouse due to lower earnings or lack of employment opportunities. In such cases, the payment of alimony by the woman helps both parties maintain their standard of living after the divorce. The decision on the material support of one of the parties is taken by the court.

How long do alimony payments take?

Temporary assistance may be awarded if one of the parties needs help finding a job or adjusting to single life after a divorce. Permanent alimony can be assigned if one of the spouses did not work and depended on the partner’s income throughout the marriage. This type of payment is usually assigned until the death of one of the spouses or his remarriage.

Men can also receive child support if they need financial support after a divorce. However, as a rule, they receive them less often than women, since they are traditionally considered breadwinners and must provide for themselves and their families.

Change or termination of alimony

If a woman earns more than her husband, the court may order her to pay spousal support. This decision depends on the specifics of each individual case and state law. The appointment of alimony after a divorce for a man is determined by such factors as the income and property of each of the spouses.

In some circumstances, both parties may agree to modify or terminate an existing support order. This is possible if there has been a significant change in the financial situation or ability to earn from one of the partners. The court will review any requests to change or stop child support before granting them to ensure they are fair to both parties.

Tax implications of alimony payments

The payer spouse must make payments by check or remittance to qualify for the tax deduction. Any payment made directly from the bank account of one spouse to the account of the other is non-deductible.

In matters of divorce and alimony, it is important to understand all the tax implications. Not always the payment of material benefits is carried out by men, sometimes women can also pay alimony for men, but this happens much less often. Only certain types of payments are deductible, so it is important to consult with a qualified financial advisor to ensure that all deductions are properly processed.